Cara Registrasi

Saw the development of the exchange of foreign currency or foreign currency was increasingly fast, then sprang up the company that made use of the profit from this exchange. It was money changer became the personal inspiration or the company to take the profit from the trade in foreign currency. More advanced again the development of trade companies in foreign currency began to develop an online method of carrying out the transaction forex/valas.Sebuah the company the trade valutas foreign that had an office the centre in England, that is Marketiva took part in undertaking the trade business in foreign currency with the online system (the internet connection). The company Marketiva provided the trade service in foreign currency with the very very simple system. Anyone could do trading foreign currency in Marketiva. The service that was provided it was said simple, because only was needed by 1 computer unit that coneksi with the internet then the person could trading foreign currency. Concerning the condition that was determined then relative was easy very much. The first condition if the candidate trader want to registered in Marketiva his condition must has had the RESIDENCY CARD/SIM or the identity card himself other. The RESIDENCY CARD/SIM or this other identity card before discan in the format file .jpeg with the measurement file might not exceed 100 family planning. The second condition was to have the email address that still was active. If has had file results scan the identity card and the email address then began to carry out the registration.

Steps in the registration really were easy. Approximately 5 minutes for the registration and the bonus the registration will be given by Marketiva.

Please visited url: marketiva

As for steps in the registration as follows:

- If being opened url Marketiva then chose the Open menu an the Account.

- the Contents form available. Especially form that had a red sign obligatory was filled up.

- After form has been filled up by the clique of the switch continue to continued

- Form optional user template chose the standard then.

- for Coupon could Passed

- the Recovery Question Contents and Recovery Answer appropriate wish

- the Clique of the switch next to continued

- Hit optional by the I article have read, understood... etc.

- the Clique finish

- the complete Message the registration will emerge: Your the account has just been created

Afterwards carried out the identification with upload file results scan the identity card. As for his method as follows:

- In web marketiva the clique of the account menu center

- chose the menu sub the account center

- the Clique of the menu services

- the Clique of the Identify Yourself menu

- to the menu browse please chose file scan the identity that would to upload

- to the menu browse the two might be chosen file that was same

- afterwards upload

After being finished you could carry out the process of the verification, this process could be carried out by means of:

- In website Marketiva chose Live Support

- Put username and clicked Connect to enter Live Chat support.

- Asked to Marketiva whether your account could be used.

- the Language might with the Indonesia language - was finished

To begin trading, trader must have software Streamster that could in download in Web Marketiva to the Get Streamster menu. After being finished download then installkan in the computer, began trading. May you be successful

The list marketiva

IndTips Forexlight

(1) the right Clique in chart, chose the menu indicator then chose Macd (Moving Avg Conv. /Divergence

Adapun setting his parameter was;

---- Fast Ema Periode: 12

---- Slow Ema Periode: 26

---- MACD SMA Periode: 6

(2) Bollinger Bands, multiple 1.2.3 and 4. As for the method setting him was as follows;

Put indicator Bollinger Bands with clik right chart, chose indicator and chose Bollinger Bands. Setting the parameter as follows;

---- Ma Type: Simple

---- the Period: 12

---- Multiple: 1,0

The clique in another place so that the parameter menu is lost, then did still put indicator Bollinger Bands that was second, Setting his parameter same (Ma Type Simple and the period 12, that was changed only Multiplenya that is: 2,0) Put again indicator Bollinger Bands with the same parameter but Multiplenya the contents 3,0. Finally continue to put again indicator Bollinger Bands Ma type Simple, the period 12 and Multiplenya 4,0. If all has been carried out correctly, meant us had 4 BB lines 4 above and 4 BB lines below. His intention was if the price was in and around 4 lines above (Upper) meant classification of the price was being in the high condition. On the other hand if the range of the price was in 4 BB lines low (Lower) then the price was being in the low condition.The Frame target that was used M5, H1, H4 and D1. MACD was used to see tren travel by or descended. Whereas Bollinger Bands Forexlight used for the reference of Open Posisi. To Bollinger Bands (BB) better OP was done at the time of candlestick touched BB 3 (the colour gold the line no. 2 from outside). Again better if touching BB 4 (the blue colour no. 1 from outside). That his condition. So every time candle was willing or trying to pass BB 2 good the Upper side/upper or Lower/low then was ready to do OP. Jika BB 3 or BB 4 of Upper that was touched, did OP Sell, Target Exit 20 pip. On the other hand if BB 3 or BB 4 of Lower that was touched, did OP Buy, Target Exit or the Profit Target 20 pip. For the additional trick, got ready if the price will head the BB line 3 or 4 good upper or lower For the line penunjuk the price before by means of the right clique chose indicator then chose horizontal line. Placed handcuffed the pass in the BB line 3 or 4. See his price was how previous order the position there. Usually forexlight used stopped order and the profit target 10 for the price in BB 3 and 20 pip for the price in BB 4. Forexlight more often used Chart Time Frame H1 to observe and the execution of the movement scanned. Apart from the indicator above, forexlight also used the other indicator that was received in flatform Enraged Trader. Metatrader could didownload in the other site. In software metatrader apart from indicators that were provided could disetting like in streamster Marketiva,The other surplus was to Metatrader could be applied by him Expert Advisor (the indicator that was drafted by the experts to analyse the movement scanned at the same time gave signal OP). Definitely not all signal was regarded as certain. For discussions concerning forex in a realtime manner, for the owner of the Marketiva account could enter to the Discussion menu and chose Group chat that was desired. For example Chat Group: Indonesia. In this forum usually was discussed concerning the problem that be connected with forex. Along with this was the example chart and the indicator marketiva that was used forexlight;

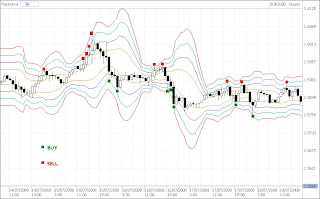

Along with this was the example of the picture during during open the good position sell or buy.

The list Now the Clique Here

Deposit And Withdraw

Forexlight chose the BCA bank as the account of the conventional bank the choice. The bank of E-currency that was chosen was Liberty Reserve because LR was received in Marketiva and it was considered legal for the method deposit and withdraw. Afterwards for the account member the service sold/bought E-currency forexlight had the account member to Indochanger. For Liberty Reserve and Indochanger did not put on the registration cost (free). If trader had three conditions that were named earlier then if the fund was ready to mean the process deposit could have been carried out. The process that happened to deposit could be illustrated as follows: Trader prepared several funds in the account of the bank konvesional (the example: BCA). Further entered to website Indochanger to order several units of LR. Setelah filled form order later trader will know how much money that must be transferred to Indochanger in accordance with order e-currency that wanted to be bought. The following process was to transfer an amount of money to Indochanger for ordering payment of several units e-currency.

The Indochanger side immediately will process order if confirmation of the transfer was accepted (money was transferred trader to the Indochanger account for payment order). Trader afterwards checked the account of Liberty Reserve. If several LR units have entered, meant to have been ready didepositkan to Marketiva. In software streamster Marketiva, opened the Center Account menu and chose the Deposit menu. The contents form deposit. If the true filling then the LR unit will at once enter the Account trader in Marketiva. The process withdraw was the opposite from the process deposit because withdraw was the process of the fund withdrawal from Marketiva to the account of the conventional bank property trader. The condition stayed same, that is having three condition accounts (Liberty Reserve, Member Changer and the account of the conventional bank). Withdraw was begun from the Center election of the Account menu in Marketiva, then filled form withdraw. After the fund entered the LR account then the number of LR units could have been sold to Changer to liquid entered the account of the conventional bank property trader. The note: Marketiva put on the cost during first withdraw (furthermore not be hit by fee again), fee withdraw was $7.

The other alternative to deposit and withdraw to Marketiva was through wiretransfer (the transfer between the bank). His condition trader only was required to have the account of the conventional bank that could give the service of the transfer service between the international bank. Marketiva put on the cost as big as $14 to every time withdraw if trader used the alternative wiretransfer. Usually the alternative wiretransfer was used by trader that want to did deposit or withdraw in the number of quite big funds.

The registration in Marketiva the clique in Here

The Registration in Liberty Reserve of the clique here

Margin and Transaksi

---- Dana real the account: $500

---- After margin to: $50.000

With the existence the value of the lever (the margin) then trader that had the account fund as big as $500, could The transaction as big as 1$ until $50.000.

But many circles trader experienced suggested to The transaction better only used 10% from the available fund in the account. Therefore to The transaction of 10%, then trader only filled quantity contract size as big as $5000.

---- 50,000 x 100/10 of = 5000

---- 5000 had the value of the movement per point as big as 0.5

---- so as if the profit 10 point then 10 x 0.5 of = $5

The margin will be seen in the value of the movement per the point (good loss or the profit).

The transaction method in Marketiva was:

If wanting to do OP Sell to scan that was wanted, for example Euro/USD, carried out the step as follows:

- in the part running price the clique very much in the line scanned Euro/USD in the column bid. - After that emerged form the transaction/Send Order.

- Instrument was filled up by EUR/USD

- Form Buy/Sell was filled up with Sell

- Price type the contents in accordance with the choice: the Limit, Market or Stop

- Duration Type: Good Till Canceled

- Price: in accordance with the wish if price type that was chosen was

:Limit/Stop.

- Quantitiy: was filled up with the value of capital that would transaction.

- Exit Stop Loss: thought price that was wanted + the capacity limit loss

**example: if price 1,5792 and the capacity suffered a loss of 30 point,

**maka 1,5792 + 30 = 1,5822. (If the price more previously touched the Exit Stoploss value **transaction meant Loss/the loss.

- Exit Target: thought price that was wanted - the point target that was wanted.

**example: if price 1,5792 and the profit target was 30 point,

**Then 1,5792 - 30 = 1,5762. (If the price beforehand touched the Exit Target value

**transaction meant the Profit/the profit.

Clearer could be seen to the Send Order Sell picture below this

If wanting to do OP BUY, the clique running price in the line scanned EURO/USD the Offer column.

- Following will emerge the box of the Send Order dialogue

- Instrument was filled up by EUR/USD

- Form Buy/Sell was filled up with Buy

- Price type the contents in accordance with the choice: the Limit, Market or Stop

- Duration Type: Good Till Canceled

- Price: in accordance with the wish if price type that was chosen was :Limit/Stop.

- Quantitiy: was filled up with the value of capital that would transaction.

- Exit Stop Loss: thought price that was wanted

- the capacity limit loss

**example: if price 1,5792 and the capacity suffered a loss of 30 point, **Then 1,5792 - 30 = 1,5762. (If the price more previously touched the Exit Stoploss value **transaction meant Loss/the loss. - Exit Target: thought price that was wanted

- the point target that was wanted. **Conth: if price 1,5792 and the profit target was 30 point,

**Then 1,5792 + 30 = 1,5822. (If the price beforehand touched the Exit Target value **transaction meant the Profit/the profit. Clearer could be seen to the picture below this

Attention: because of the existence of the difference between the selling price and bought (spread), then Order the transaction to Sell the reference open him was continue to the Sell price but the Stoploss reference and the reference of Exit Target were the price to Buy (Offer). On the other hand same, if Order the transaction to Buy the reference open him was continue to the price buy but the Stoploss reference and Exit Target were the price to Sell (Bid). When during Send Order the price did not yet touch the point that was wanted then send order still was in the column order (the menu order) with the Active status. If afterwards has touched the point that was wanted then the Status in the column order would open likewise in the column open will be seen clear Open Position that transaction along with other information, for example one of them was how many values point that was received. The profit or Loss. To Marketiva point the red colour meant the condition loss and green meant the condition for the profit.

The Marketiva list

What of Forex

Forex: was the abbreviation from foreign exchange. The term that more was known in Indonesia to be the exchange of foreign currency/foreign currency. Forex online was the exchange transaction of foreign currency that was done through the internet media.

The business forex online now often had been known and involved in by the individual. Because relative internet access was easy and to enter to the business forex online too much was not difficult, then this business became the choice that was appropriate as the producer income.

The transaction trick forex online, was bought in the price that as low as possible and sold in the expensive price. Important to know when during that was exact entered the market or open position and when during not open position. This was valid was good for the position sell/sold (short position) and the position buy/bought (long position). Short and long position was the position open in the other term sold/bought. In the column running price Marketiva this position was acknowledged as the position bid (the column sell) and the position offer (the column buy). From the column running price this trader could observe the value of the movement some scanned in a realtime manner. Apart from running price, the movement scanned also could be observed through the graph. Especially the graph (chart), the movement scanned could be observed per 5 minutes (M5), per 30 minutes (M30), per 1 hour (H1), per 4 hours (H4),Daily or per 1 day (D1), per 1 week (W1) and per 1 month (MN). Observed chart better used chart the kind candlestick (CS), because chart the kind candlestick this also could be made the implement to analis the condition for the price (travel by or descended).

Followed the business forex online too much was not difficult. Only with internet access and 1 computer unit or laptop then this business could have been undertaken. The problem of capital of investment, now forex online had many choices. The number of values deposit was not required high or was determined. Marketiva as the broker forex online in fact provided capital of early $5 real money as the registration bonus (clearer could be seen in the page of Marketiva Bonus $5). The fact is the business forex online was the business that high risk-high return, meaning that this business involved a high risk but his consequences this business also had the value of the high profit of the return also. Could the person (trader) only in several minutes Got the profit that many times over, was the reverse could trader in this business only several minutes experienced the very big loss. This condition made trader must be careful and thorough in carrying out the transaction. If having knowledge that was adequate in this business, then the possibility of the loss will be increasingly small.

Generally trader to the business forex online this before must have the analysis capacity of the movement scanned (the foreign currency couple) that was traded in. The analysis method that often was used trader had two methods: the analysis tecnical and the fundamental analysis.

The analysis teknikal referred in the analysis that was helped by indicators that were provided in the form of the computer program. Marketiva personally offered many indicators in software streamster to help the capacity trader in analysing the movement scanned.

The fundamental analysis was the analysis that referred in the financial data of a country and factors that influenced finance of this country. This data biasany could be seen in news or the news of currency/finance of a country. The news that release had the impact or impact certain, usually was classed in three transaction impact, that is; high impact (high), the medium impact (while) and low impact (low). To access the fundamental news could visit the site: www.forexfactory.com the Forexlight Suggestion: If the beginner who wanted to be involved in the business forex online, studied about the analysis method teknikal and fundamental. After that the test and sharpened the analysis capacity with used virtual money (money virtual that was provided by Marketiva). Counted The percentage of the return of capital and the profit. If being ready, just began with realmoney (money for real investment) in the small number previously. Referred in the suggestion most trader that for a long time the business forex online, used realmonye totalling 10% of the capital for OP (open position).

The other suggestion, outside studied the analysis teknikal and fundamental, trader also must have money management (the management of finance) that was good. Money management was needed because of the business forex online that was high risk - high return.

Money management covered how many funds that were invested for this business, how many percent of the fund that transaction, how when OP was wrong the direction (was contrary to the direction pegerakan the price), and how respond to loss (the loss) and the profit (the profit). Studied money management and greetings the success.

Marketiva

Trading

Forexlight used one file to calculation the profit every time trading. You could download file this the clique here. In file in the format file excel this could calculation the profit/the profit trading. If already didownload then was opened file the illustration trading this. Saw, capital in hari01 that is: $5. and the end profit in the low column was: $21,2. If want to knew the following month profit remained the substitute the value of capital of early $5 to $21,2. Then the number of second month profits was $90,1. Henceforth did again the same thing, put the value $90,1 To capital of early hari01, and saw the end profit that is in the third month, that is as big as: $382,7. If being converted to rupiahs, for example $1 was the same as Rp. 9000, then the profit that was received only by capital of the bonus that was received through the registration that is around Rp. 3,444,582. A sufficient number not? . Nah, if you began trading the suggestion forexlight used the available indicator in Indtips, applied in a manner discipline. Don't Open the position more than 2 positions. Follow the calculation input quantity like available in file the illustration trading.

To know update the development of the latest news concerning foreign currency sorts, please visited:

www.forexfactory.com

The list in Marketiva the clique in here

The List in Liberty Reserve of the clique here

Trading

Forexlight menggunakan sebuah file untuk mengkalkulasikan profit setiap trading. Anda bisa download file tersebut klik di sini. Pada file dalam format file excel ini dapat dikalkulasikan keuntungan/profit trading. Jika sudah didownload maka bukalah file ilustrasi trading tersebut. Lihat, modal pada hari01 yaitu : $5. dan profit akhir pada kolom bawah adalah: $21,2. Jika ingin mengetahui profit bulan berikutnya tinggal ganti nilai modal awal $5 menjadi $21,2. Maka jumlah profit bulan kedua adalah $90,1. Seterusnya lakukan lagi hal yang sama, masukkan nilai $90,1 pada modal awal hari01, dan lihat profit akhir yaitu pada bulan ketiga, yaitu sebesar : $382,7. Jika dirupiahkan, misalkan $1 sama dengan Rp. 9000, maka profit yang diperoleh hanya dengan modal bonus yang diperoleh melalui pendaftaran yaitu sekitar Rp. 3.444.582. Jumlah yang cukup banyak bukan?.

Nah, jika Anda memulai trading saran forexlight gunakan indikator yang ada di Indtips, terapkan secara disiplin. Jangan Open posisi lebih dari 2 posisi. Ikuti perhitungan input quantity seperti yang ada di file ilustrasi trading.

Untuk mengetahui update perkembangan berita terkini mengenai macam-macam mata uang asing, silahkan kunjungi: www.forexfactory.com

Daftar di Marketiva klik di sini

Daftar di Liberty Reserve klik di sini

IndTips Forexlight

Style Chart yang digunakan forexlight adalah CandleStick (CS). Pada chart style CS, informasi harga cukup jelas terlihat, baik kondisi naik atau turun pada TF tertentu (misalkan tf H1). Chart candlestick Marketiva memberikan gambaran jika kondisi harga naik maka isi dari balok candle berwarna putih. Sedangkan jika isi balok candle berwarna hitam maka kondisi pergerakan harga adalah turun. Sehingga pada Target Frame kecil sangat membantu dalam memutuskan untuk melakukan OP semaksimal mungkin :-).

Untuk mensetting indikator pada chart Marketiva, forexlight terlebih dahulu memilih chart yang akan disetting. Standar dari Marketiva adalah chart Euro/USD tf H1 dengan chart style : line. Pertama-tama, gantilah style chart line dengan candlestick dengan cara mengklik kanan chart dan pilih menu style. Klik kanan lagi pada chart Euro/USD tersebut dan pilih zoom 125% agar bentuk candlestick terlihat jelas. Biasanya Marketiva sudah menambahkan 2 garis indikator Moving Average (MA). Hilangkan saja garis MA tersebut dengan cara mengklik garis tersebut. Nanti akan muncul menu setting parameter MA tersebut dan pilih menu Remove This Indicator. Selanjutnya lakukan lagi dengan mengklik garis MA yang kedua dan pilih remove lagi. Nah sekarang berarti pada chart hanya tampak tampilan Candlestick saja. Lalu mulailah memasukkan indicator yang baru. Indikator teknikal yang digunakan forexlight adalah MACD dan Bollinger Bands. Cara settingnya adalah sebagai berikut :

(1) Klik kanan pada chart, pilih menu indicator lalu pilih Macd (Moving Avg Conv./Divergence

Adapun setting parameternya adalah ;

----Fast EMA Periode : 12

----Slow EMA Periode : 26

----MACD SMA Periode : 6

(2) Bollinger Bands, multiple 1,2,3 dan 4. Adapun cara settingnya adalah sebagai berikut ;

Masukkan indicator Bollinger Bands dengan mengklik kanan chart, pilih indicator dan pilih Bollinger Bands. Setting parameter sebagai berikut ;

----MA Type : Simple

----Periode : 12

----Multiple: 1.0

Klik di tempat lain agar menu parameter hilang, lalu lakukan lagi memasukkan indicator Bollinger Bands yang kedua, Setting parameternya sama (MA Type Simple dan periode 12, yang diganti hanya Multiplenya yaitu : 2.0) Masukkan lagi indicator Bollinger Bands dengan parameter sama tapi Multiplenya isi 3.0. Terakhir tetap masukkan lagi indicator Bollinger Bands MA type Simple, periode 12 dan Multiplenya 4.0. Jika semua sudah dilakukan dengan benar, berarti kita telah memiliki 4 garis BB 4 diatas dan 4 garis BB di bawah. Maksudnya adalah jika harga berada di sekitar 4 garis di atas (Upper) berarti klasifikasi harga sedang berada dalam kondisi tinggi. Sebaliknya jika kisaran harga berada di 4 garis BB bawah (Lower) maka harga sedang berada pada kondisi rendah.

Target Frame yang digunakan M5, H1, H4 dan D1.

MACD digunakan untuk melihat tren naik atau turun. Sedangkan Bollinger Bands Forexlight gunakan untuk acuan Open Posisi. Pada Bollinger Bands (BB) sebaiknya OP dilakukan pada saat candlestick menyentuh BB 3 (warna gold garis no. 2 dari luar). Lebih bagus lagi jika sudah menyentuh BB 4 (warna biru no. 1 dari luar). Itu syaratnya. Jadi setiap candle akan atau sedang berusaha melewati BB 2 baik sisi Upper/atas atau Lower/bawah maka bersiaplah melakukan OP. Jika BB 3 atau BB 4 Upper yang tersentuh, lakukan OP Sell, Target Exit 20 pip. Sebaliknya jika BB 3 atau BB 4 Lower yang tersentuh, lakukan OP Buy, Target Exit atau Target Profit 20 pip. Buat trik tambahan, bersiaplah jika harga akan menuju garis BB 3 atau 4 baik upper atau lower. buatlah garis penunjuk harga terlebih dahulu dengan cara klik kanan pilih indicator lalu pilih horizontal line. Letakkan gari pas di garis BB 3 atau 4. Lihat harganya berapa lalu order posisi di situ. Biasanya forexlight menggunakan stop order dan target profit 10 untuk harga di BB 3 dan 20 pip untuk harga di BB 4. Forexlight lebih sering menggunakan Chart Time Frame H1 untuk mengamati dan eksekusi pergerakan pair.

Selain indikator diatas, forexlight juga menggunakan indikator lain yang terdapat di flatform Meta Trader. Metatrader dapat didownload di situs lain. Pada software metatrader selain indikator-indikator yang disediakan dapat disetting seperti pada streamster Marketiva, kelebihan lain ada lah pada Metatrader dapat diterapkannya Expert Advisor (indikator yang dirancang para ahli untuk menganalisa pergerakan pair sekaligus memberikan signal OP). Tentunya tidak semua signal dianggap pasti. Untuk diskusi mengenai forex secara realtime, bagi pemilik account Marketiva dapat masuk pada menu Discussion dan memilih Group chat yang dikehendaki. Misalkan Chat Group : Indonesia. Pada forum ini biasanya dibahas mengenai masalah yang berhubungan dengan forex.

Berikut ini adalah contoh chart dan indikator marketiva yang digunakan forexlight (klik pada gambar untuk memperjelas tampilan):

Berikut ini adalah contoh gambar saat saat open posisi baik sell atau buy.

Daftar Sekarang Klik Disini

Deposit And Withdraw

Withdraw : menarik sejumlah dana dari account Marketiva

E-currency : mata uang elektronik yang sah sebagai alat pembayaran

Changer : Penyedia jasa jual/beli e-currency

Ketika seorang trader memutuskan telah siap secara finansial untuk melakukan transaksi forex online di Marketiva, maka yang perlu dilakukan adalah menyetor/mentransfer sejumlah dana ke account di Marketiva. Ada beberapa dua option/pilihan cara melakukan deposit, yaitu : melalui transfer e-currency dan transfer antar bank (wiretransfer).

Untuk dapat melakukan deposit/transfer melalui e-currency trader harus memiliki tiga account syarat. (1) memiliki rekening bank konvensional, seperti : BCA, Mandiri, Lippo dan lain-lain. (2) memiliki account E-currency. (3) Memiliki account member pada penyedia jasa jual/beli E-currency.

Forexlight memilih bank BCA sebagai rekening bank konvensional pilihan. Bank E-currency yang dipilih adalah Liberty Reserve karena LR diterima di Marketiva dan dianggap sah untuk metode deposit dan withdraw. Kemudian untuk account member jasa jual/beli E-currency forexlight memiliki account member pada Indochanger. Untuk Liberty Reserve dan Indochanger tidak mengenakan biaya registrasi (free).

jika trader telah memiliki tiga syarat yang disebutkan tadi maka jika dana telah siap berarti proses deposit sudah bisa dilakukan. Proses yang terjadi untuk deposit dapat diilustrasikan sebagai berikut: Trader menyiapkan sejumlah dana di rekening bank konvesional (contoh : BCA). Selanjutnya masuk ke website Indochanger untuk order sejumlah unit LR. Setelah mengisi form order nanti trader akan tahu berapa jumlah uang yang harus ditransfer ke Indochanger sesuai dengan order e-currency yang ingin dibeli. Proses berikutnya adalah mentransfer sejumlah uang kepada Indochanger untuk pembayaran pemesanan sejumlah unit e-currency. Pihak Indochanger akan langsung memproses order jika konfirmasi transfer telah diterima (uang telah ditransfer trader ke rekening Indochanger untuk pembayaran order). Trader kemudian mengecek account Liberty Reserve. Jika sejumlah unit LR sudah masuk, berarti sudah siap didepositkan ke Marketiva. Pada software streamster Marketiva, buka menu Account Center dan pilih menu Deposit. Isi form deposit. Jika pengisian benar maka unit LR akan langsung masuk ke Account trader di Marketiva.

Proses withdraw merupakan kebalikan dari proses deposit karena withdraw adalah proses penarikan dana dari Marketiva ke rekening bank konvensional milik trader. Syarat tetap sama, yaitu memiliki tiga account syarat (Liberty Reserve, Member Changer dan rekening bank konvensional). Withdraw dimulai dari pemilihan menu Account Center di Marketiva, lalu mengisi form withdraw. Setelah dana masuk di account LR maka jumlah unit LR sudah bisa dijual ke Changer supaya cair masuk ke rekening bank konvensional milik trader. Catatan : Marketiva mengenakan biaya saat pertama withdraw (selanjutnya tidak kena fee lagi), fee withdraw adalah $7.

Alternatif lain untuk deposit dan withdraw pada Marketiva adalah melalui wiretransfer (transfer antar bank). Syaratnya trader hanya diharuskan memiliki rekening bank konvensional yang dapat memberikan jasa layanan transfer antar bank antar negara. Marketiva mengenakan biaya sebesar $14 untuk setiap withdraw jika trader menggunakan alternatif wiretransfer. Biasanya alternatif wiretransfer digunakan oleh trader yang ingin melakukan deposit atau withdraw dalam jumlah dana yang cukup besar.

Registrasi di Marketiva klik di sini

Registrasi di Liberty Reserve klik di sini

Margin and Transaksi

----Dana real account : $500

----Setelah dimarginkan menjadi : $50.000

Dengan adanya nilai pengungkit (margin) maka trader yang memiliki dana account sebesar $500, akan dapat bertransaksi sebesar 1$ sampai $50.000.

Tetapi banyak kalangan trader berpengalaman menyarankan untuk bertransaksi sebaiknya hanya menggunakan 10% saja dari dana yang ada di account. Dengan demikian untuk bertraksaksi sebesar 10%, maka trader hanya mengisi quantity contract size sebesar $5000.

----50.000 x 100 / 10 = 5000

----5000 memiliki nilai pergerakan per point sebesar 0.5

----sehingga jika profit 10 point maka 10 x 0.5 = $5

Margin akan terlihat pada nilai pergerakan per poin (baik loss atau profit).

Cara Transaksi di Marketiva adalah :

Jika ingin melakukan OP Sell untuk pair yang diinginkan, misalkan Euro/USD, lakukan langkah sebagai berikut :

- Pada bagian running price klik sekali di baris pair Euro/USD di kolom bid.

- Setelah itu muncul form transaksi/Send Order.

- Instrument diisi EUR/USD

- Form Buy/Sell diisi dengan Sell

- Price type isi sesuai dengan pilihan : Limit, Market atau Stop

- Duration Type : Good Till Canceled

- Price : sesuai keinginan jika price type yang dipilih adalah :Limit/Stop.

- Quantitiy : diisi dengan nilai modal yang akan ditransaksikan.

- Exit Stop Loss : nilai price yang diinginkan + batas kemampuan loss

**Contoh : jika price 1.5792 dan kemampuan menanggung kerugian sebesar 30 point,

**maka 1.5792 + 30 = 1.5822. (Jika harga lebih dulu menyentuh nilai Exit Stoploss

**transaksi berarti Loss/rugi.

- Exit Target : nilai price yang diinginkan - target poin yang diinginkan.

**Conth : jika price 1.5792 dan target profit adalah 30 point,

**maka 1.5792 - 30 = 1.5762. (Jika harga lebih dahulu menyentuh nilai Exit Target

**transaksi berarti Profit/untung.

Lebih jelas dapat dilihat pada gambar Send Order Sell di bawah ini

Jika ingin melakukan OP BUY, klik running price di baris pair EURO/USD kolom Offer.

- Berikutnya akan muncul kotak dialog Send Order

- Instrument diisi EUR/USD

- Form Buy/Sell diisi dengan Buy

- Price type isi sesuai dengan pilihan : Limit, Market atau Stop

- Duration Type : Good Till Canceled

- Price : sesuai keinginan jika price type yang dipilih adalah :Limit/Stop.

- Quantitiy : diisi dengan nilai modal yang akan ditransaksikan.

- Exit Stop Loss : nilai price yang diinginkan - batas kemampuan loss

**Contoh : jika price 1.5792 dan kemampuan menanggung kerugian sebesar 30 point,

**maka 1.5792 - 30 = 1.5762. (Jika harga lebih dulu menyentuh nilai Exit Stoploss

**transaksi berarti Loss/rugi.

- Exit Target : nilai price yang diinginkan - target poin yang diinginkan.

**Conth : jika price 1.5792 dan target profit adalah 30 point,

**maka 1.5792 + 30 = 1.5822. (Jika harga lebih dahulu menyentuh nilai Exit Target

**transaksi berarti Profit/untung.

Lebih jelas dapat dilihat pada gambar di bawah ini

Perhatian : karena adanya selisih antara harga jual dan beli (spread), maka Order transaksi pada Sell acuan opennya adalah tetap harga Sell tetapi acuan Stoploss dan acuan Exit Target adalah harga pada Buy (Offer). Sebaliknya juga sama, jika Order transaksi pada Buy acuan opennya adalah tetap harga buy tetapi acuan Stoploss dan Exit Target adalah harga pada Sell (Bid). Ketika saat Send Order harga belum menyentuh titik yang diinginkan maka send order masih berada di kolom order (menu order) dengan status Aktif. Jika kemudian sudah menyentuh titik yang diinginkan maka Status di kolom order akan open demikian juga di kolom open akan terlihat jelas Open Position yang ditransaksikan berikut keterangan lainnya, misalkan salah satunya adalah berapa nilai point yang sedang diperoleh. Profit atau Loss. Pada Marketiva point warna merah berarti kondisi loss dan hijau berarti kondisi profit.

Daftar Marketiva

Cara Registrasi

Bonus $5

Melihat perkembangan pertukaran mata uang asing atau valas semakin pesat, maka bermunculanlah perusahaan yang memanfaatkan keuntungan dari pertukaran tersebut. Adalah money changer menjadi ilham personal atau perusahaan untuk mengambil keuntungan dari perdagangan mata uang asing. Lebih maju lagi perkembangan perusahaan-perusahaan perdagangan valas mulai mengembangkan suatu metode online untuk melakukan transaksi forex/valas.Sebuah perusahaan perdaganganan valutas asing yang berkantor pusat di Inggris, yaitu Marketiva turut menjalankan bisnis perdagangan valuta asing dengan sistem online (koneksi internet). Perusahan Marketiva menyediakan layanan perdagangan valas dengan sistem yang sangat sederhana sekali. Siapa saja dapat melakukan trading valas di Marketiva. Layanan yang disediakan dikatakan sederhana, karena hanya diperlukan 1 unit komputer yang terkoneksi dengan internet maka orang akan dapat bertrading valas.

Mengenai syarat yang ditentukan pun relatif mudah sekali. Syarat pertama jika calon trader ingin mendaftar di Marketiva syaratnya harus sudah memiliki KTP/SIM atau kartu identitas diri lainnya. KTP/SIM atau kartu identitas lainnya ini terlebih dahulu discan dalam format file .jpeg dengan ukuran file tidak boleh melebihi 100 kb. Syarat kedua adalah memiliki alamat email yang masih aktif. Jika sudah memiliki file hasil scan kartu identitas dan alamat email maka mulailah melakukan registrasi.

Langkah-langkah registrasi sangat mudah. Kurang lebih 5 menit untuk registrasi dan bonus registrasi akan diberikan oleh Marketiva.

Silahkan kunjungi url : marketiva

Adapun langkah-langkah registrasi sebagai berikut :

- Jika sudah membuka url Marketiva maka pilihlah menu Open an Account.

- Isi form yang ada. Khusus form isian yang bertanda merah wajib diisi.

- Setelah form isian sudah terisi klik tombol continue untuk melanjutkan

- Form optional user template pilih standar saja.

- Untuk Coupon bisa dilewatkan

- Isi Recovery Question dan Recovery Answer sesuai keinginan

- Klik tombol next untuk melanjutkan

- Centang optional di samping tulisan I have read, understood ... etc.

- Klik finish

- Pesan komplit registrasi akan muncul : Your account has just been created

Kemudian lakukanlah identifikasi dengan mengupload file hasil scan kartu identitas. Adapun caranya sebagai berikut :

- Pada web marketiva klik menu account center

- Pilih menu sub account center

- Klik menu services

- Klik menu Identify Yourself

- Pada menu browse silahkan pilih file scan identitas yang akan diupload

- Pada menu browse kedua boleh dipilih file yang sama

- kemudian upload

Setelah selesai Anda dapat melakukan proses verifikasi, proses ini dapat dilakukan dengan cara :

- Pada website Marketiva pilihlah Live Support

- Masukkan username dan klik Connect untuk masuk ke Live Chat support.

- Tanyakanlah kepada Marketiva apakah account Anda telah bisa digunakan.

- Bahasa boleh dengan bahasa Indonesia

- Selesai

Untuk memulai trading, trader harus memiliki software Streamster yang bisa di download di Web Marketiva pada menu Get Streamster. Setelah selesai download maka installkan di komputer, mulailah trading. Sukses selalu

Daftar Disini

Apa Itu Forex

Bisnis forex online sekarang sudah banyak dikenal dan digeluti oleh perseorangan. Karena akses internet yang relatif mudah dan untuk terjun ke bisnis forex online tidak terlalu sulit, maka bisnis ini menjadi pilihan yang layak sebagai penghasil income.

Trik transaksi forex online, adalah membeli di harga yang serendah-rendahnya dan menjual di harga yang tinggi. Penting untuk mengetahui kapan saat yang tepat masuk pasar atau open position dan kapan saat tidak open position. Ini berlaku baik untuk posisi sell/jual (short position) dan posisi buy/beli (long position). Short dan long position adalah posisi open dalam sebutan lain jual/beli. Pada kolom running price Marketiva posisi ini disebut sebagai posisi bid (kolom sell) dan posisi offer (kolom buy). Dari kolom running price inilah trader dapat mengamati nilai pergerakan suatu pair secara realtime. Selain running price, pergerakan pair juga dapat diamati melalui grafik. Khusus grafik (chart), pergerakan pair bisa diamati per 5 menit (M5), per 30 menit (M30), per 1 jam (H1), per 4 jam (H4), daily atau per 1 hari (D1), per 1 minggu (W1) dan per 1 bulan (MN). Mengamati chart sebaiknya menggunakan chart jenis candlestick (CS), karena chart jenis candlestick ini juga bisa dijadikan alat untuk mengganalisa kondisi harga (naik atau turun).

Menekuni bisnis forex online tidak terlalu sulit. Hanya dengan akses internet dan 1 unit komputer atau laptop maka bisnis ini sudah dapat dijalankan. Masalah modal investasi, sekarang forex online memiliki banyak pilihan. Jumlah nilai deposit tidak diharuskan tinggi atau ditentukan. Marketiva sebagai broker forex online bahkan menyediakan modal awal $5 real money sebagai bonus registrasi (lebih jelas dapat dilihat di halaman Marketiva Bonus $5).

Kenyataannya bisnis forex online merupakan bisnis yang high risk-high return, artinya bisnis ini beresiko tinggi tapi konsekuensinya bisnis ini juga memiliki nilai pengembalian keuntungan yang tinggi pula. Bisa saja orang (trader) hanya dalam beberapa menit mendapatkan keuntungan yang berlipat-lipat, sebaliknya bisa saja trader dalam bisnis ini hanya beberapa menit mengalami kerugian yang sangat besar. Kondisi ini menjadikan trader harus berhati-hati dan teliti dalam melakukan transaksi. Jika telah memiliki pengetahuan yang memadai dalam bisnis ini, maka kemungkinan kerugian akan semakin kecil.

Umumnya trader untuk menekuni bisnis forex online ini terlebih dahulu harus memiliki kemampuan analisa pergerakan pair (pasangan mata uang asing) yang diperdagangkan. Metode analisa yang kerap digunakan trader ada dua metode: analisa teknikal dan analisa fundamental.

Analisa teknikal mengacu pada analisa yang dibantu oleh indikator-indikator yang disediakan dalam bentuk program komputer. Marketiva sendiri menawarkan banyak indikator-indikator dalam software streamster untuk membantu kemampuan trader dalam menganalisa pergerakan pair.

Analisa fundamental merupakan analisa yang mengacu pada data keuangan suatu negara dan faktor-faktor yang mempengaruhi keuangan suatu negara tersebut. Data ini biasany dapat dilihat pada news atau berita mata uang/keuangan suatu negara. Berita yang release memiliki dampak atau impact tertentu, biasanya digolongkan dalam tiga tinggakatan impact, yaitu ; high impact (tinggi), medium impact (sedang) dan low impact (rendah). Untuk mengakses berita fundamental dapat mengunjungi situs : www.forexfactory.com

Saran Forexlight : Jika pemula yang ingin menggeluti bisnis forex online, belajarlah tentang metode analisa teknikal dan fundamental. Setelah itu uji dan asah kemampuan analisa dengan menggunakan virtual money (uang virtual yang disediakan Marketiva). Hitung prosentasi pengembalian modal dan keuntungan. Jika telah siap, baru mulailah dengan realmoney (uang investasi nyata) dalam jumlah yang kecil dulu. Mengacu pada saran kebanyakan trader yang sudah lama menekuni bisnis forex online, gunakanlah realmonye sebanyak 10% dari modal untuk OP (open position).

Saran lain, diluar mempelajari analisa teknikal dan fundamental, trader juga harus memiliki money management (manajemen keuangan) yang baik. Money management dibutuhkan karena bisnis forex online yang bersifat high risk - high return.

Money management meliputi berapa dana yang diinvestasikan untuk bisnis ini, berapa persen dana yang ditransaksikan, bagaimana saat OP salah arah (berlawanan dengan arah pegerakan harga), dan bagaimana menyikapi loss (rugi) dan profit (untung). Pelajari money management dan salam sukses.